Do I have to declare my benefits at BetHunter?

Do BetHunter winnings have to be declared? This, in fact, is the same as asking, Are sports betting winnings declared?

As this question is not an easy one, we are going to dedicate this post (and possibly some more in the future) to dealing with the taxation of sports betting .

Keep in mind that this guide is applicable to bets produced in bookies that operate in Spain (those whose domain ends in .es). If you operate from abroad, you must abide by the legislation of that country, although we have already told you that it is most likely that in this case, your earnings will be exempt from taxation.

The Income Tax of Physical Persons

First of all, we must understand how we have to communicate our benefits to the Treasury. And that way is the personal income tax declaration, the tax that people who live in Spain pay based on the money we earn each year. It is a progressive tax, that is, the more we earn, the more we will pay to the State.

As a natural person, you can have five different types of income:

- Work performance,

- Returns on movable capital,

- Returns on real estate capital,

- Income from economic activities and,

- Capital gains and losses.

It is in this last point of gains and losses of a patrimonial nature where the gains that we have achieved with BetHunter are included, and must be declared as “winnings in sports betting”.

If in addition to what you have won with BetHunter, you have made your own sports bets, you must add (subtract) your profits (losses) to what you have obtained thanks to us.

Likewise, if you have used other online gaming products, such as casinos or poker, or have invested in financial products, such as shares or mutual funds, you can offset your profits or losses under this heading as well.

Do I have to declare my benefits in any case?

Do not. Not always. If you have earned less than 1,600 throughout the year adding all your income, you will not have to declare your benefits. For example, a student with no income who has purchased only one Elite plan (€1,500 of benefits) throughout the year would not have to declare their benefits.

An Elite plan and a Rookie? So yes (€1,500 + €285).

In general, whenever you earn more than €1,600 for any reason, the Treasury will ask you for a bribe. How wonderful, right?

In case it is not clear, let’s review this with some examples:

- In my work I have earned 20,000 euros last year and I have bought a BetHunter Rookie plan (285 euros profit): YES I must declare.

- At my job I earned 5,000 euros last year and bought a BetHunter Premium plan (800 euros profit): YES, I must declare.

- I do not have a job or other income and I have bought a BetHunter Elite plan (1,500 euros of benefit): I do NOT have to declare.

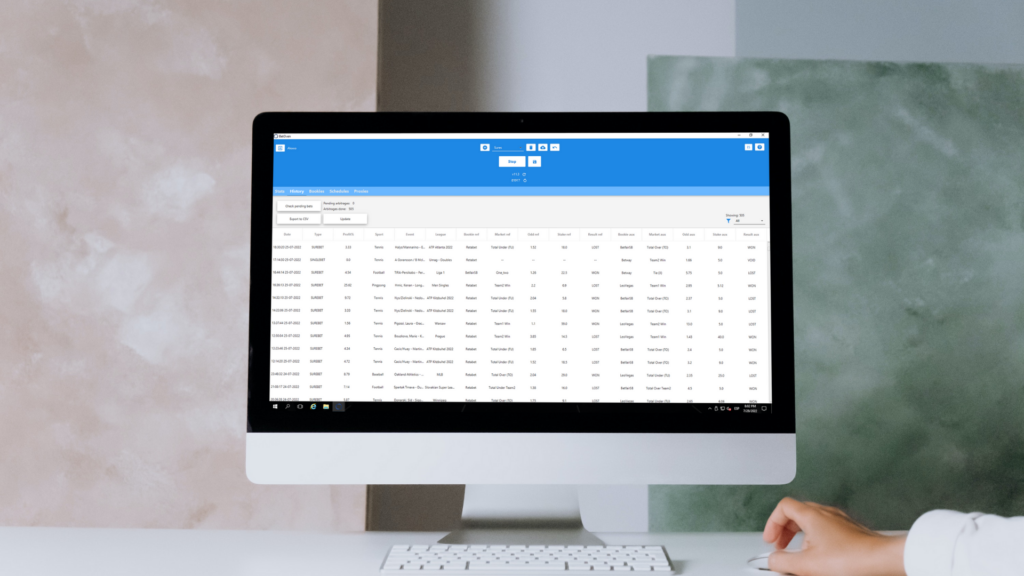

The accounts to know if your benefits in sports betting must be taxed are counted by calendar year, that is, by what has happened between the first and the last day of each year. Most bookmakers offer you an annual report to find out how your accounts have been in each year, although the truth is that they are very easy to calculate through this equation:

Benefits = Balance as of December 31 – Balance as of January 1 – Deposits + Withdrawals

At BetHunter several bookies are used, how is this calculated?

We will have to use the previous equation in all the bookies that we have used throughout the year. If in some bookies we have won and in others we have lost, we have to make the final count by discounting the losses from the gains between all of them.

Received bonuses and unwithdrawn balance

Most of the bookmakers offer welcome bonuses when we register and sometimes they also do promotions when we are already customers. Remember that we do NOT compute these profits as produced by BetHunter . That is to say, if you buy an Elite plan, you will earn €1,500, and also what you enter thanks to the bookmaker bonuses.

However, the Treasury does want its share of the cake from those bonuses . Therefore, you have to include them in your statement: if we receive 100 euros as a welcome bonus and we have won 800 euros thanks to BetHunter, in total we will have won 900 euros.

Another common question is whether to declare the benefits obtained even if they have not withdrawn anything from the bookmakers. The answer is YES , since that money is yours from the moment you have earned it and it has the same value whether it is in the balance of a bookie or in our bank account. You will have to put in the statement the balance you have as of December 31.

What happens if I don’t report my earnings?

In theory, the bookmakers communicate the information of the profits of their clients to the Treasury. In any case, confronting the Treasury is a risk that may not be worth taking, because if we receive an inspection. In that case, in addition to paying the amount that we should have already paid at the time, we will have to face a fine that can be up to 100% of the profits obtained.

We will be adding posts with more information on regulation and taxation in the world of sports betting . If you want to know everything, subscribe to our Newsletter.